On the Recursion-Exscientia Tie-Up

Just a couple of weeks ago, Recursion announced that it had entered into a definitive agreement with Exscientia to combine business entities, creating a “Global Technology-Enabled Drug Discovery Leader with End-to-End Capabilities”. Since then, I’ve fielded a number of questions from clients, friends and former colleagues about what this means and what I think of it. So I figured I’d write down and share some thoughts on one of the biggest pieces of news in the TechBio world since, well, the dawn of that world. Full disclosure: I’m confident I’m biased in my perceptions, given the ~8 years I spent at Recursion, much of that in top-level leadership positions. But hopefully that bias-causing experience can add some color to this agreement for others, and add something to the excellent thoughts provided by others previously (see here and here).

To assess this tie-up properly, there are two key pieces of context around Recursion’s mindset that I think are likely needed first. Then I’ll dive into specifics about the tie-up.

Context

Piece #1 - The Meta-Experiment

(If you don’t know what I mean by meta-experiment, read this before continuing)

The first thing you need to understand is Recursion’s ambitions. This company did not set out to discover a couple of new medicines. It did not set out to create a typical successful biotech that brings 1-2 new treatments to market. It saw (as many others have) the decreasing returns on pharma R&D investment, and the increasing cost and difficulty of discovering new therapeutics, and set out to change the trajectory of that curve. From the early days, Recursion has aimed to run the meta-experiment of tech-enabled drug discovery: can the marriage of computational technologies, automated biological experimentation and unbiased systems biology yield drug candidates that are either A) more likely to succeed in the clinic, B) cheaper to discover, and C) faster to discover? I would argue that this is what Recursion set out to test. Yes, it has its own flavor of tech-enabled drug discovery (that is more systems biology focused vs chemistry focused). Yes, there are many others setting out to run the same meta-experiment. And lastly, yes, it’s a costly experiment to run. But it is at the center of what makes Recursion Recursion, and it’s important to understand this if you are to make sense of the decisions Recursion makes.

Piece #2 - Shifting Probability Masses

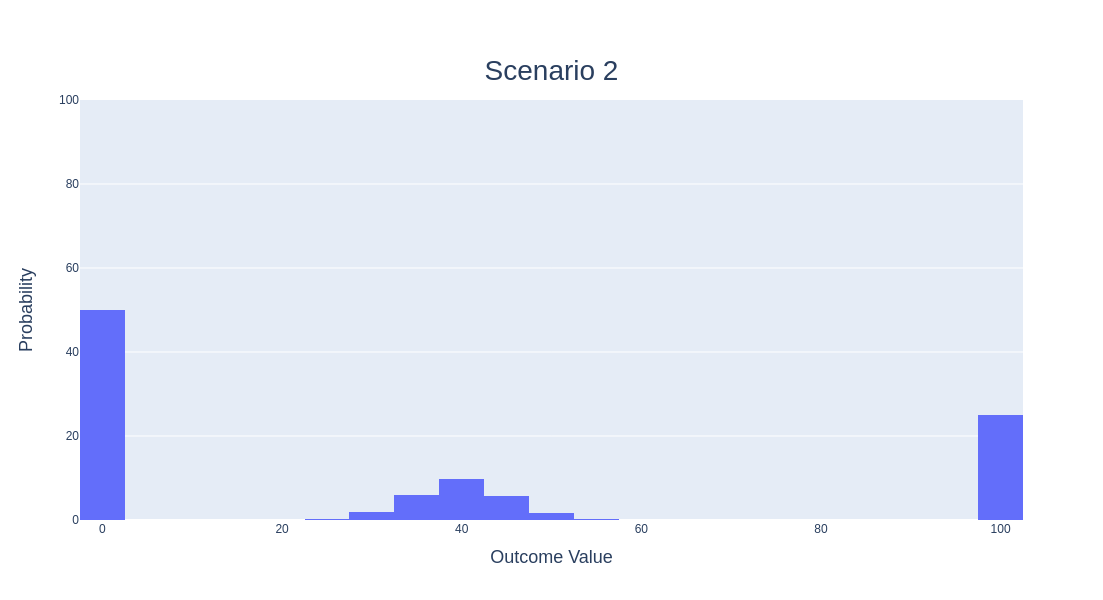

The next thing you need to understand is how seriously Recursion takes this meta-experiment. The leadership there, especially Chris Gibson, know what they are trying to test and are doing their best to stay true to it. One of the things we used to tell candidates applying to Recursion was “When making a decision between two options where one has a lower probability of utter failure, higher probability of moderate success and low probability of ultimate success, vs the other option having a higher probability of lower failure, lower probability of moderate success, but higher probability of ultimate success, we’ll choose the latter every time.” That’s a mouthful, so it might be best to illustrate this with some figures.

Assume the outcome for Recursion is a mixture model with three components. Component #1 (centered on the x-axis at 0) represents utter failure (no drugs make it to patients), Component #2 (centered on the x-axis at 40) represents moderate success (maybe 1-2 drugs make it to patients), and Component #3 (centered on the x-axis at 100) represents complete success (Recursion has created a platform that can continuously find new drug candidates either more cheaply, quickly or with a higher likelihood of translational success). The way Recursion thinks about its meta-experiment tends to value Scenario #2 (the bottom) over Scenario #1 (the top), even though Scenario #2 has a much higher probability of failure (50%) vs Scenario #1 (10%) and thus a much lower probability of success (50% vs 90%). But it does so because the probability of ultimate success is 25% instead of 1%. It’s a bold, swing-for-the-fences mindset. And it’s not for everyone. Not all employees like it, not all potential partners, and certainly not all investors. But it’s true to Recursion’s meta-experiment.

I think this tie-up should be viewed under three lenses:

What it does for their platform

What it does for their pipeline and partnerships (primary monetization engines)

What it does for their meta-experiment

Platform

While I wasn’t expecting to see the news when it hit, it also didn’t surprise me at all. Something along these lines had been a consideration of ours at Recursion probably since late 2018 or early 2019, often described as the “Bold Bet”, involving a consolidation and larger tie-up of several different entities into a united whole, creating a true “full-stack” techbio company (“full-stack” being most commonly used to describe both frontend and backend development of software applications, in this case referring to the “end-to-end capabilities” noted in Recursion’s press release above). Recursion’s stronghold has always been in biology, specifically in experimental biology driven by automation and coupled tightly with computation. That carried the company far for years, and was more full-stack than most biotechs had been, but it still lacked various necessary components for true end-to-end drug discovery and development, notably advanced chemistry, real-world patient data and innovative clinical development capabilities. While Recursion has had some of these capabilities for years, they have for the most part been fairly traditional (sometimes exceptional, but still traditional). Recursion started hiring a very talented and competent medicinal chemistry team back in 2018 as well as building out its clinical development department shortly thereafter, but these teams were not necessarily equipped to employ emerging technological capabilities in their domains.

But that’s been changing over the past 18 months, starting with the acquisitions of Cyclica (a computational chemistry team based out of Toronto that built products focused on modeling small molecule target-binding polypharmacology and enabling technology guided design of small molecules given a desired target activity profile) and Valence Discovery (a promising ML-for-chemistry group in Montreal, working on cutting-edge methods in the field). These acquisitions provided a much-needed boost to Recursion’s digital chemistry efforts, as internally it never really had the deep expertise needed, though it had dabbled in the space for years (myself frequently involved in the dabbling), and the two specific acquisitions aligned well with some other factors at play (the geographic locations already aligned well with Recursion’s new offices in Toronto and Montreal, and Recursion and Valence had already shared a common luminary mentor in Yoshua Bengio). Shortly thereafter, Recursion started bolstering its real-world patient-centric data with its collaborations with Tempus in 2023 and later Helix the following year, both datasets quickly being put to good use by Recursion’s teams to combine real-world data with its growing maps of experimental biology for novel target discovery. Between those two collaborations, Recursion further advanced its efforts in tech-enabled chemistry through its collaboration with Enamine, which was fully enabled by its MatchMaker tool (acquired via Cyclica) and its novel target discovery capabilities (from its maps of biology, later augmented by the real-world patient data from Tempus and Helix). While each of these capability additions wouldn’t be considered the “Bold Bet”, they were effectively and slowly filling out Recursion’s technology and platform gaps in meaningful, targeted ways.

The tie-up announcement with Exscientia is definitely the single largest effort to complement Recursion’s existing platform technologies. While I was not present at Recursion for any of the due diligence into Exscientia’s tech, it appears that the primary components expected to bring value are its “precision chemistry tools and capabilities” along with its “automated small molecule synthesis platform” (while Exscientia certainly brings additional technology capabilities in terms of its precision experimentation in patient tissues, these don’t appear to be mentioned in the definitive agreement announcement). So basically, more chemistry, which suggests that Recursion’s acquisitions of Cyclica and Valence did not provide sufficient depth of capabilities in this dimension, or what is more likely in my opinion, that chemistry is a big complex problem and the initial acquisitions showed Recursion its promise, convincing them that further investment was warranted. Certainly neither Cyclica nor Valence had reduced their ML chemistry capabilities to practice in a way that has led to multiple clinical programs like Exscientia has, and this may be the real kicker. The capabilities from Cyclica have already been put to use in creating predicted binding scores for all 36B molecules in Enamine REAL Space, as well as to be the digital driver of the Enamine libraries being created in their collaboration, but are likely only recently impacting the most recent advanced programs in Recursion’s pipeline. On the other hand, given that Exscientia’s focus has been on its precision chemistry, seeking for best-in-class assets, its approaches are presumably far more battle tested, which is advantageous to Recursion.

And then there is the newly minted automated small molecule synthesis platform built by Exscientia. This has been a gleam in Recursion’s eye for years, with efforts being initiated in late 2021, but later deprioritized and pivoted into a DMPK suite capable of executing highly-valuable assays at a previously impossible scale. Being able to leverage an automated synthesis platform in a more autonomous manner has long been desired by Recursion leadership, especially if it can be closely coupled with Recursion’s scaled -omics assays (e.g. phenomics, transcriptomics). Unfortunately, Recursion’s automation platforms for phenomics and transcriptomics are located at its headquarters in Salt Lake City, Utah, while the Exscientia automated synthesis platform is not, preventing the true synergies from being immediately realized. Furthermore, the extent of Exscientia’s automated synthesis platform is somewhat murky, as the complexity of synthetic routes available, the ability to perform multi-step synthesis, and the levels of purification involved are not yet public. As Exscientiat’s platform is described as “newly commissioned”, the level of battle testing is likely light but must have been promising to the recursion diligence team - it will be exciting to see information emerge over the coming quarters about the capabilities, diversity of accessible chemical space, and throughput of this microsynthesis platform.

In summary, the platform capabilities seem largely complementary, with Exscientia providing technologies long desired at Recursion. While Recursion may have been biology-first (even after the Cyclica and Valence acquisitions of 2023), the new combined entity will likely have a much greater balance of biology and chemistry technology capabilities, truly bringing the platform closer to full-stack, end-to-end capabilities.

Pipeline and Partnerships

Pipeline

The tie-up here also merges two pipelines together, with minimal competitive overlap. Recursion’s existing pipeline largely consisted of first-in-class assets, or at least first-in-indication assets, Exscientia’s pipeline has been focused on best-in-class compounds. Sometimes people look at Recursion’s pipeline and scratch their heads, but when you understand the context of how it was built up, it makes more sense. Here feels as good a place as any to explain it, so I’ll give it a shot.

As mentioned previously, Recursion’s identity early on centered around repurposing shelved assets for rare, monogenic loss-of-function diseases. The idea was to treat this large class of diseases (which have very little in common) as a common class of diseases in how you model them. Since they were monogenic, just knockdown (RNAi) or knockout (CRISPR) the causative gene, measure the effects, and then test to see which compounds can reverse those effects. Doing this well requires a very rich and largely unbiased representation of biological state, and fluorescent microscopy images fit the bill. This was the early version of Recursion, where phenomics was used with genetic knockdowns and/or knockouts on primary human cells to model a disease, and small molecules (shelved assets, tool compounds, later some NCEs) were tested via brute force screening to identify which ones had positive effects in reversing a complex, high-dimensional phenotype of the disease model. Since all of the diseases examined were monogenic loss-of-function, you could largely keep everything fixed except the genetic perturbations. It was from this that Recursion’s earliest and most advanced assets came: REC-994 for CCM, REC-2282 for NF2 and REC-4881 for FAP - a bunch of repurposed assets for a bunch of rare diseases.

***Beginning of Side Rant*** Many people find criticism with Recursion’s earliest assets, saying they didn’t come from the platform. These people simply do not understand what they are talking about. Recursion’s initial tech-enabled drug discovery platform centered specifically around radical empiricism, high-throughput, high-content phenotypic screening of shelved assets against monogenic loss-of-function disease models with impressive computer vision and data processing capabilities to learn abstract representations of biology that could identify these repurposing opportunities systematically. And then Recursion just went and in-licensed the compounds (when it could) to drive them into the clinic (and often people wouldn’t part with their assets for a number of reasons). Did Recursion’s platform design the compounds? No. But the AI was never focused on design - it was focused on finding the latent opportunities nobody else could see. Not the “AI for Drug Discovery” lots of people think of, but don’t judge Recursion just because it AI’s differently than you do.

Also, Recursion’s platform has evolved substantially over the years since the first assets were discovered. It shifted from only using siRNA to model diseases to use CRISPR, soluble factors and other modalities as well. It was limited to only examining tool compounds or shelved assets, but now enables full hit-to-lead and lead optimization directly on the platform to produce novel chemical assets. It previously used CellProfiler pipelines and now uses foundation vision-transformer models trained on the largest morphological imaging dataset that exists in the world. It changed from brute-force screening of compounds to inferential drug discovery with maps of biology. It transitioned from only phenomics to now use phenomics, transcriptomics, proteomics and digital in vivo representations to drive its discovery. So yes, the most advanced assets were in-licensed and used a much earlier version of the platform, but they’re still from “the platform”. Recursion did not just go out and pick random assets independent of what the platform indicated, unlike some other tech-enabled drug discovery companies I’m familiar with. Every single asset it has brought forth towards the clinic came from some information arbitrage its platform identified. ***End of Side Rant***

Over time Recursion realized that its platform could be used for more than just monogenic, loss-of-function diseases, as well as that there likely wasn’t as much low hanging fruit to be plucked from the repurposing tree, especially when restricting to diseases with limited populations. This led to the emergence of some of its next programs, such as REC-3964, applied to Clostridioides difficile infection (modeled phenotypically by adding CDiff toxin to primary cells), which is not repurposed but actually fully optimized by Recursion’s early medicinal chemistry team directly on the phenomic readouts (Recursion’s first NCE asset). At this point we add an “Other” indication, with an NCE.

As Recursion’s data scale continued to grow and it completed its first whole genome arrayed CRISPR knockout screens and scaled compound profiling screens (up to hundreds of thousands of small molecules tested at a few concentrations), it recognized it could use these data to create “maps” of biology and chemistry, where relationships between entities are inferred by their degree of similarity in a high-dimensional latent space learned from the recorded images. These maps could be used for a number of purposes, such as target discovery, hit prediction, and mechanism of action deconvolution. This spurred the next wave of programs, mostly centered in oncology, such as REC-4881’s expansion into AXIN1/APC-mutant cancers and REC-1245 for HR-proficient cancers via its targeting of RBM39. So now we have some NCEs for oncology indications, and more likely coming. But this discovery approach is not limited to oncology, as maps have now been generated and even optioned by Recursion’s partnership with Roche-Genentech for the area of neuroscience.

While I cannot tell you the history of Exscientia’s lead assets, it appears that the targets and indications come from a more traditional approach. Teams of intelligent scientists (probably backed by some kind of LLM combing through literature and/or a knowledge graph to identify well validated targets) pick targets they think are derisked, but that have been traditionally difficult to drug selectively. Exscientia’s precision chemistry platform identifies and optimizes compounds to hit these targets, and hopefully this gives you a best-in-class pipeline of drugs. And it appears they’ve largely focused on oncology, except for their BMS-licensed compound designed to treat inflammatory diseases.

Now looking at these two pipelines, it’s clear there is an “Other” bucket and an “Oncology” bucket. The “Other” bucket consists of a number of rare-disease assets, and one for each of infectious disease, inflammation and fibrosis (the latter two stemming from current or prior collaborations with partners), and the “Oncology” bucket appears to be where most momentum exists for new programs and work, excluding those programs coming from their partnership activities. Let’s talk about those partnerships a bit more now.

Partnerships

While the partnerships (with Roche-Genentech, Bayer, Sanofi and Merck KGaA) provide the potential for significant runway extending capital in the near term (potentially $200M over the next 24 months) and long term (potentially $20B), plus royalties, let’s not focus on the numbers. I think we all know that those dollars are still just possible, so discount them heavily. That said, there is something interesting here to note about each entity in this tie-up:

Recursion

Recursion’s collaboration with Roche-Genentech is interesting in that unlike typical pharma deals, this one has significant milestone payments triggered not just upon candidates advancing past certain stages (which has already happened once) but also triggered upon successful dataset creation and optioning (which just happened, triggering a $30M payment). Why is this significant? It is a whole new field of monetization somewhat unique to Recursion’s platform, wherein the data maps themselves are deemed highly valuable and not just the small molecule assets. Having options and milestone payments associated with both traditional therapeutic assets and biological datasets creates multiple financial shots on goal for Recursion to capture non-dilutive capital, and the fact that we’ve seen the first realization of this is exciting. Kudos to the hard working teams that produced Recursion’s first neuroscience phenomap for the collaboration!

Exscientia

If Exscientia’s internal pipeline seems lacking on some dimensions, it has shown quite a bit of success in its past and present partnerships, including 9 programs optioned across oncology and immunology, two partnered programs continuing in Phase 1 studies with its prior partner Sumitomo Pharma, and its BMS-partnered inflammation program in Phase 1 and an ENPP1 inhibitor with Rallybio expecting to achieve development status before year’s end. The degree to which Exscientia has delivered on and monetized its past partnerships bodes well for the combined entity moving forward.

The Meta Experiment

Recursion has long aimed to run the meta-experiment of the union of modern computation with experimental biology and chemistry to either accelerate, decrease the costs of, or increase the success rates of drug discovery and development. So far that’s been a hypothesis that hasn’t been fully tested by anyone, and actually conducting the test with sufficient resources to see you through that test is challenging. Most companies are only able to put forward a couple candidates into the clinic, and if the success rate of each candidate in a Phase 2 POC is only ~30% and the company’s platform “edge” should supposedly increase the success rate by 10% (which might not seem like a lot but would still be a great win), measuring that improvement isn’t really possible with just a few assets. One might say that the companies just need to keep advancing their next candidates until you have a large enough N to actually answer the meta-experiment question. Unfortunately, unless you have a sufficient war chest and a sufficiently deep pipeline, you won’t be able to test a large enough N in time. You’ll have to raise more capital (if you can) between readouts and possibly slash your pipeline, deprioritizing some candidates in favor of others.

Recursion has long aimed to avoid this problem, wanting to have 10 candidates that could all line up and read out in clinical trials between funding rounds. That’s hard to pull off, both in terms of funding amount (that’s a lot of cash to support that many trials), funding timing (hard to get all of that funding secured at the right time, given macroeconomic conditions), and science (hard to get that many solid programs progressing and maturing to roughly the same phase at roughly the same time). Recursion alone started getting close to this point, announcing in June 2024 that it would have 7 clinical readouts in the following 18 months, assuming its runway could last that long (which at the moment, it couldn’t, given its burn rate). It immediately followed that announcement up with a $200M public offering, which it was punished for in the markets, as expected, but which secured sufficient runway to run the experiment. Barely. But with the planned merger with cash-rich Exscientia (relative to its burn rate), Recursion’s war chest grows to around $850M along with another three Phase 1 (or near-Phase 1) assets and another Phase 2 asset that should read out well before hitting the end of their combined runway. This gives the combined entity 11 assets that can presumably be read out before they truly need to raise more capital (assuming they can manage their spending and not grow it significantly over the coming couple of years). In fact one could argue that you have even more than those 11 assets, given those already partnered and advanced through some of their collaborations. Which sets the combined entity up well to run the experiment Recursion has wanted to be able to conduct for years, a meta-experiment the industry, and the world, needs to see conducted for the field of TechBio to be decidedly worthwhile or premature. I’m obviously hoping for the former.

Where Things Could Get Messy

You might have determined by now that I think this tie-up is net positive. I truly believe this has the potential to be a 1+1=3 moment. I’m also not wholly naive, and recognize that a lot could go wrong.

Platform

The respective platforms appear complementary, but the physical aspects of them can pose a challenge to the full synergy possible. Even if Exscientia’s automated synthesis platform is as good as one could hope, it’s still an ocean away from Recursion’s phenomics and transcriptomics platforms, posing a real barrier to closed-loop discovery. Exscientia may have great best-in-class precision chemistry capabilities (not fully validated yet) and Recursion may have a great platform for biological exploration, hypothesis generation and target discovery. Combining them together couples the risks. If both live up to the hope and promises, then together they will create an incredibly powerful platform. If either one fails to live up to expectations, it could hamper the capabilities of the other.

Pipeline

The pipelines are certainly therapeutically complementary (or at least non-competitive), but 10+ programs to prosecute simultaneously requires a lot of capital. The ~$850M war chest is a lot, but without discipline it could run down faster than you’d expect. Recursion’s burn rate is very high - it costs a lot of money to generate as much data for its maps of biology and chemistry as Recursion creates, for itself and its partnerships. Exscientia appears to have had greater discipline in terms of spending, and it’s possible that some of that discipline could be adopted within the new Recursion. But if Recursion’s burn rate influences Exscientia the other way, it could be to the detriment of both of them. I think it’s imperative that the combined entity do everything necessary to ensure that its runway extends through the readouts for all of its advanced assets. Even doing this will likely cause some pain and create some messes.

Meta-Experiment

It’s not going to be a perfect experiment, since we’re actually seeing the combining of two separate experiments mid-stream. Each experiment alone is likely insufficiently powered to make any real conclusions, and combined they may be too confounded. That said, there does not appear any reason to believe that either company is likely worse than the status quo, so if one is actually better alone, then that gives good reason to hope that the experiment will still come out positive.

Everything Else

Merging two companies together is non-trivial. I’ve experienced multiple acquisitions at this point. I’ve been acquired in a much smaller company that did not go as desired, and I’ve led the acquisition of a much smaller company that went well, but still far from perfect. Increase the size of companies 100 fold and it’s bound to be far messier and harder to pull off. I can’t imagine the “annual synergies in excess of $100 million” not involving significant staff layoffs due to role redundancies and seeking greater efficiency. And at this magnitude, that will be complicated to pull off. If the potential layoffs are too skewed one way or the other, I can imagine a very challenging “us-vs-them” scenario emerging, making it difficult for the two entities to truly become one united company. For the sake of the future business, I hope any moves to this effect will be appropriately balanced and focused on creating the most effective tech-enabled drug discovery workforce possible, even if it means some of my beloved Recursionauts will no longer be with the go-forward entity. Maybe that’ll mean they’ll have more time to come hang out with me 🙂

Final Thoughts

The Recursion-Exscientia tie-up announcement possibly launches a new phase for the world of TechBio. This isn’t just a collaboration between two entities, and it isn’t just an acquisition of a much smaller, private start-up. This is effectively a slightly-skewed merger of two of the world leaders in technology-enabled drug discovery. Over the years many have entered the stage, often causing the earlier, more naive version of myself great angst: insitro (launched in 2018, with the much better known Daphne Koller telling the world of a bold, new vision of computation and science for drug discovery), Flagship-founded Cellarity (launched publicly in late 2019, with a great, similar vision and some killer branding), and Valo Health (another insanely well-funded Flagship Pioneering company that emerged from stealth in 2020 with a couple of its own acquisitions to bolster its nascent capabilities). Of all of these, and in many ways against the odds, Recursion and Exscientia both emerged as top players in the space, with platforms and clinical portfolios that held their own in comparison to much better funded and credentialed biotech executive teams (trust me, I know - somehow even I ended up on Recursion’s executive team). Recursion and Exscientia were the two that were able to position themselves to enter the public markets and access yet additional funding just before the biotech winter started setting in late 2021. And now we’re seeing the two consolidate into a single entity that has the potential to be the defining figure in the TechBio space. Let’s hope they get it right.